SMU DataArts Is Better Together

Lessons Learned from the Newly Merged Nonprofit and the Funder’s Collaborative That Supported It

Setting the Frame

Financial support is just one element required to successfully and proactively merge institutions. In this article we describe Better Together Fund’s philosophy and intended impact as a pilot program that encourages and supports nonprofits to explore formal, long-term collaborations as a way to maximize their own impact. To illustrate an application of Better Together Fund’s model, we share the case of one of its 2018 Implementation Grants: the merger of SMU’s National Center for Arts Research (NCAR) and DataArts, the reputable, Philadelphia-based national resource for in-depth data about nonprofit arts, culture, and humanities organizations.

Better Together Fund

Even communities with a robust nonprofit ecosystem too often develop increased needs that outpace the nonprofit growth rate. These communities may face unmet demands and may include organizations that cannot achieve meaningful scale. They may also host nonprofits producing duplicative efforts. Such imbalances can affect an organization’s financial viability and leadership. All of this can make it difficult for nonprofits to focus on long-term goals, take risks on new ideas, and achieve maximum impact. The Better Together Fund was launched to empower nonprofits and address these underlying sector dynamics.1

In 2017, several Dallas-based funding organizations came together to strengthen the sector based on belief that there is power in going beyond the traditional organizational boundaries and doing together what cannot be done alone. The Dallas Foundation, Lyda Hill Philanthropies, The Meadows Foundation, and the United Way of Metropolitan Dallas launched the Better Together Fund as a pilot program to drive large-scale change by supporting nonprofits to explore formal, long-term collaborations as a way to maximize impact.

After extensive research on similar funds across the country, such as the New York Merger and Collaboration Fund, the Nonprofit Repositioning Fund in Philadelphia, and the Nonprofit Sustainability Initiative in Los Angeles, the Better Together Fund was designed to provide end-to-end support and offer grant funding from $3,000 to $600,000, covering staff time, consultants, and other costs associated with exploring, planning, and implementing a formal collaboration such as a merger or strategic alliance.

For the Better Together Fund, success looks like the following:

Big ideas. Multiple organizations create significant impact doing together what they could not have done individually.

Efficiency. The region’s nonprofit sector is strengthened by aligning complementary strengths and resources.

Exploration only. The Better Together Fund is excited by organizations that explore coming together formally and strategically elect not to. They will move on with a better understanding of the landscape and their distinct roles.

The new norm. Conversations become more routine at the board and leadership level about considering formal collaboration as a way to solve problems and have more impact.

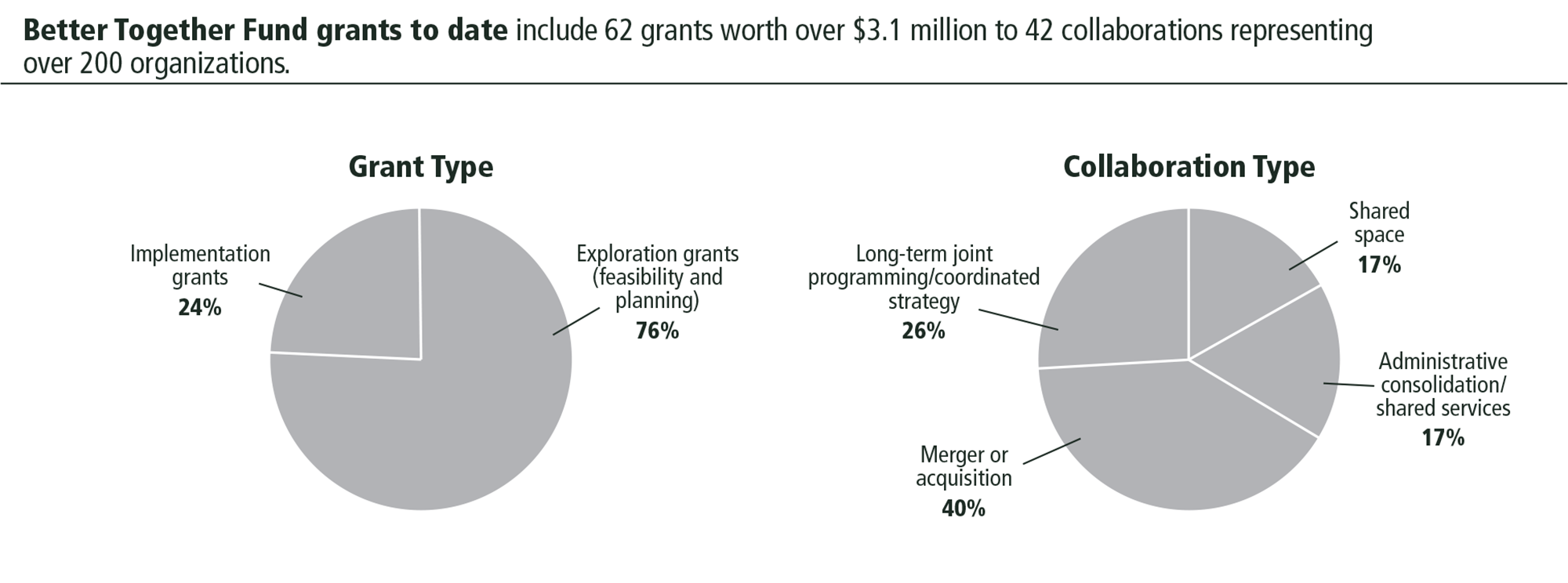

The Better Together Fund defines formal collaboration as the relationship between one nonprofit and another nonprofit, corporation, or governmental agency that changes the way participating organizations do business for the long-term, has board involvement and endorsement, and preserves, expands, or improves efficiency and services to constituents. In its first two years, the Better Together Fund has awarded sixty-two grants worth over $3,100,000 to forty-two unique collaborations representing over two hundred organizations.

Here are seven important lessons learned from the first two years of the Better Together Fund:

- Triggering moments matter.2 Our experience mirrors what experts have witnessed for decades. Collaboration is often prompted by a major inflection point, such as leadership transition, adapting to change, the loss of a significant funding stream, or scaling successful interventions.

- The executive director and the board are both key to success. While the executive director is far more likely to initiate collaboration discussions than the board, boards are critical in creating an environment where executive directors feel empowered to begin these discussions, and in evaluating particular opportunities. We have found that if a project does not feature early board involvement, it is unlikely to yield a successful formal, long-term collaboration.

- Collaborations require more than a check. We are finding that deeper engagement beyond funding can be beneficial to the collaboration, whether that is ongoing communications with the team, the boards, or technical assistance providers. We are, however, mindful of power dynamics and the risk of being too pushy or prescriptive. Yet, with so many “soft” elements at play, some grantees welcome an extra sounding board, a thought partner, or a nudge to keep the project a priority.

- Third parties bring crucial objectivity. Grantees have shared that engaging a neutral and experienced third party to facilitate negotiations was critical to staying on course. Organizations engaged in the process cannot be expected to have the time, resources, or neutrality to effectively manage what are often sensitive and delicate negotiations between executives and boards. In our experience, a carefully selected and jointly retained consultant with the right capabilities can be vital in bringing discipline to the process, and in ensuring clear communication between the organizations.

- Doing the deal is one thing. Making it work is another. “Making the deal work” is an ongoing — and sometimes messy — process that is often more complicated and costly than initially expected. Funders and partnering organizations need to plan for long-term engagement to institutionalize formal collaborations.

- Mergers are a sign of strength, not weakness. Research shows that the most common collaborations are between strong and stable organizations. We have found this to be true with 40 percent of our funded collaborations that have explored or implemented a merger or acquisition. In nearly every case, merger exploration comes from a desire to strengthen the mission rather than from financial weakness.

- The not-so-secret ingredient is still trust. We know that collaboration occurs at the speed of trust. Many grantees emphasized that trust is the glue that holds together the process and needs to be created, nurtured, and sustained by funders and partners alike.

A Case in Point

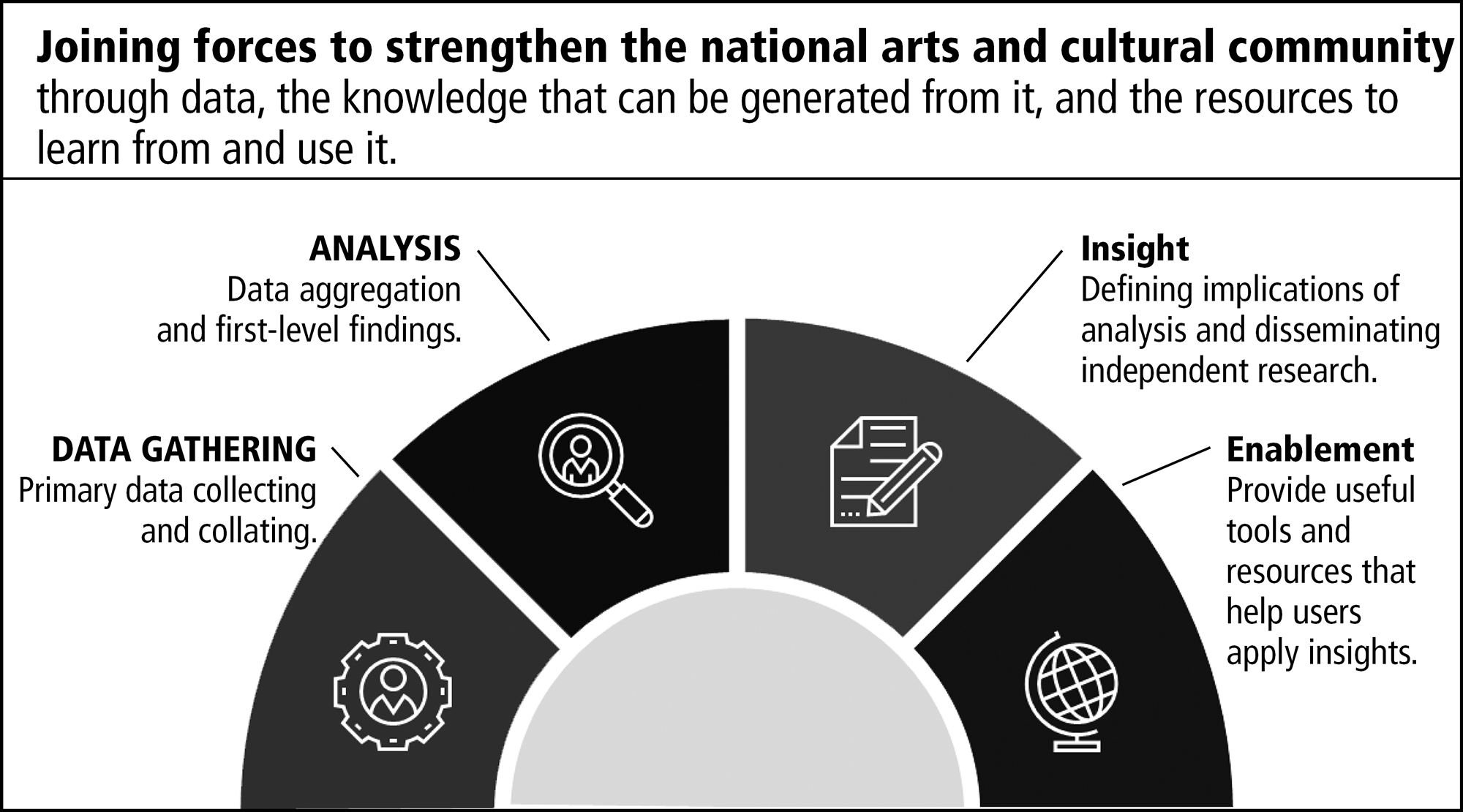

DataArts and NCAR merged in August 2018. The two joined forces to strengthen the national arts and cultural community through data, the knowledge that can be generated from it, and the resources to learn from and use it.

The triggering moment that started these two organizations along the merger path was the announced departure of DataArts’ president and CEO. Rather than expectedly launching into the search for a new CEO, DataArts’ board leadership decided to pause and consider whether a merger might make more strategic sense as a path forward. In this case, early board involvement meant taking initiative to seek out potential merger partners. NCAR and DataArts had been collaborating closely since NCAR’s founding in 2012, so it was a logical alliance to explore. The two had a history of trust, and both entered into the merger discussions from positions of strength.

The organizations’ missions were similar despite different approaches toward fulfillment. As a result, they possessed different yet complementary strengths and capabilities. Through the merger, DataArts’ Cultural Data Profile (CDP) data collection platform and its relationships with arts organizations and grantmakers were combined with NCAR’s research expertise, partnerships with other data providers, and the resources of a major research university. This combination results in not only increased efficiency due to having data collection live under the same roof as research power but also synergies as a merged organization. In this new form, the two could create significant impact doing together what they could not have done individually. The merger represented a vertical integration of legacy organizations that expanded both their scopes.

The new entity continues the core operations of both organizations while creating a uniquely comprehensive center for data on the arts sector, including data collection, analysis, and research and development of educational tools and resources for the field. Its collective vision is to build a culture of data-driven decision making for those who want to see the arts and culture sector thrive. Numerous new grantmakers and partners have responded to this vision by engaging with SMU DataArts to generate insights and knowledge that could have come about only from their combined capabilities.3

Better Together Fund’s support and thought partnership were key to the merger’s success. Recognizing that third parties bring crucial objectivity, Better Together Fund provided support and recommendations to engage a change management consultant, a human resource transition consultant, and a marketing and public relations consulting firm. Third-party expertise related to onetime, merger-specific events was essential. This was the first time that either of the organizations involved had undertaken a merger. There was no reason to expect that without past experience, either could anticipate everything that might arise during a merger, or that either possessed the knowledge or capabilities to deal with unique, merger-related circumstances. Better Together Fund also supported the recommendation developed with the change management consultant to bring together the staff members of the legacy organizations for two sessions, one in Philadelphia and one in Dallas. These retreats were critical to getting the people part of the merger right.

Doing the deal is one thing. Making it work is another. Three key lessons prevailed in this particular case:

- The external world will care about what it means for them, not what it means for you. The big question in contemplating a merger is whether you can do more for the field together than you can separately. It is critical to articulate clearly why you will matter and how you will be useful in meeting key stakeholder needs. The merger has to make sense for all of the internally motivated reasons described above, but if you are only doing this for yourselves, why should anyone else take interest?

- All the task integration in the world will mean nothing if you don’t get the human integration right. The merger literature is filled with counsel on the importance of getting the people part right. We gave deep consideration to the facets of our work that could remain separate and to those where capitalizing on the synergies of combining team members of both legacy organizations would be essential to success. Better Together Fund provided support to hire a human resource transition and change management consultant, who provided guidance through the all-staff retreats, helped create an integrated organizational culture, and facilitated merged staff work groups. The approach was to create three teams composed of staff across departments of both legacy organizations, focused on creating strategies that advance three first-year goals of the combined organization. The task of collective strategizing and problem solving created a unified sense of purpose and established the foundation of the new organization’s culture. This is an evolving process, which leads to the third lesson.

- You don’t really merge on merger day, and that’s okay. A corporate consultant with merger experience shared this wisdom early in the process. It is a license to accept the things you cannot change immediately, and it gives permission to all involved to do the same. Deep learning about one another takes time, as does understanding what works well where.

In addition to support of onetime merger expenses from the Better Together Fund, the Nonprofit Repositioning Fund and a handful of key donors of each of the legacy organizations helped to instill broader confidence among grantmakers and individual donors that merging made sense.

We like to think about mergers or other forms of formal collaboration as one arrow in a nonprofit’s quiver. We should view exploring formal collaboration in the same way we view strategic planning and program evaluation: as best practices and tools to strengthen effectiveness.

Better Together Fund offers an instructive model that can be applied in other communities. Mergers are not the answer for all organizations. When a merger makes sense, its success takes the full support of all stakeholders and funders who are willing to be catalysts in the process. A merger does not represent the normal activity of arts nonprofits. It is an exceptional event that requires patience, trust, expertise, and the objectivity to clearly assess the strategic pros and cons that underlie every merger decision.

Margaret Black is a director at Lyda Hill Philanthropies and LH Capital Inc. She oversees a portfolio of grants, impact investments, and initiatives that fund transformational advances in science and nature and empower nonprofit organizations. Her work includes stewarding the Better Together Fund.

Dr. Zannie Voss is director of SMU DataArts|National Center for Arts Research and professor of arts management in SMU’s Meadows School of the Arts and Cox School of Business. Her research on the strategic factors that influence organizational performance appears in over a dozen academic and practitioner journals.

NOTES

- To learn more about the Better Together Fund, visit www.bettertogetherfund.org.

- The Power of Possibility, a campaign developed by BoardSource, offers focused resources to help guide discussion about considering formal collaboration during these critical triggering moments: www.thepowerofpossibility.org.

- To learn more about SMU DataArts, visit www.culturaldata.org.